Jay Peck: Not just your average realtor

What can a top producer do with a tough "no" agent? Jay Peck can work wonders.

He adds with a laugh: "Any agent can do what I do." With a combination of his people skills, sales ability, and expertise in dealing with luxury properties, Jay Peck has, in a relatively short time, hit stardom for creativity and effectively marketing high-end real estate. His venture into the real estate industry started in 2013, when he was just 22. Despite being inexperienced and unaware of the industry, he sought his business partner's investment advice. In 2013, he acquired a property, which turned out to be a wise way in hiring. "After my purchase," he remembers, "I bought it quickly.

I was inexperienced and had no real knowledge of what I was getting myself into." Despite the excitement surrounding the purchase, Jay Peck now acknowledges that he could have made a better decision if he had the right information about real estate and proper guidance. "It's a top priority for me that my clients make purchases with sound guidance and all the right information they need." - Jay Peck

A good realtor during the cooling measures that the government implemented in 2020 and 2021, when sales were sky-high, he says, "I could have made the wrong decision if I had been in the market for a long time, but rather than the one I chose." Jay Peck has learned a lot about the real estate business since it came to selling. However, the entire process has taught him how to navigate the competitive real estate market and understand its complexities.

Empowering clients and elevating customer service

Four years later, he courageously chose to become a realtor. His motivation was to navigate the complex world of real estate confidently and knowledgeably. Stemming from his own less-than-positive experience as a buyer, Peck’s approach to his work is marked by his dedication to educating himself and transferring new knowledge to consumers. He says: “I don’t want others to have the same experience I did, so it’s a top priority for me that my clients make purchases with sound guidance and all the right information they need.”

To reinforce this, Peck regularly gets invited to speak at consumer seminars, which empower individuals new to property acquisition to gain the knowledge and skills to enter the property market with confidence and clarity. Peck’s previous experience as a flight attendant with Singapore Airlines also gave him valuable skills and qualities that proved instrumental in his interactions with real estate clients, offering a distinctive perspective.

“Being a cabin crew member of a premium carrier gave me a lot of exposure,” he says. “I’ve had the pleasure of serving diverse clients, each with unique needs and preferences.” This knowledge and awareness have given him the edge in recommending properties. “For example, I now know that certain nationalities are more receptive to properties with a west-facing orientation, a stark contrast to what many Singaporeans prefer.”

He can communicate well and offer superior options to his clients. His understanding and appreciation of luxury and quality items also mean he is more aware of premium home finishings. This enables him to alert buyers and assist sellers in marketing their homes more efficiently. Peck adds: “My clients looking for luxury homes don’t have much time to view many properties and so it helps them when I’m able to shortlist and curate suitable options so that their time is not wasted.”

Special Projects: The Keppel Bay Collection

Such insights have inspired Peck to devise a unique business method, such as grouping homes into collections. One of his initiatives, “The Keppel Bay Collection”, a set of resale homes in the Harbourfront area, is among the special offerings he selects for clients as a one-stop shop. Peck believes that being an agent with in-depth knowledge of not just one but multiple units within a property or neighbouring properties means he can better add value to keen buyers.

Special Projects: Edgeprop Chart Toppers

As someone with a portfolio of units under his purview, I see many sellers in the area seeing profitable returns under Peck’s guidance. He has successfully matched their units to savvy buyers looking for underrated gems to invest in. “The key is to choose a unit that not only meets your current needs but also has the potential to withstand the test of time,” Peck adds. “It is easier for buyers to find such a unit if they have a range of options, which is why I curated this collection.”

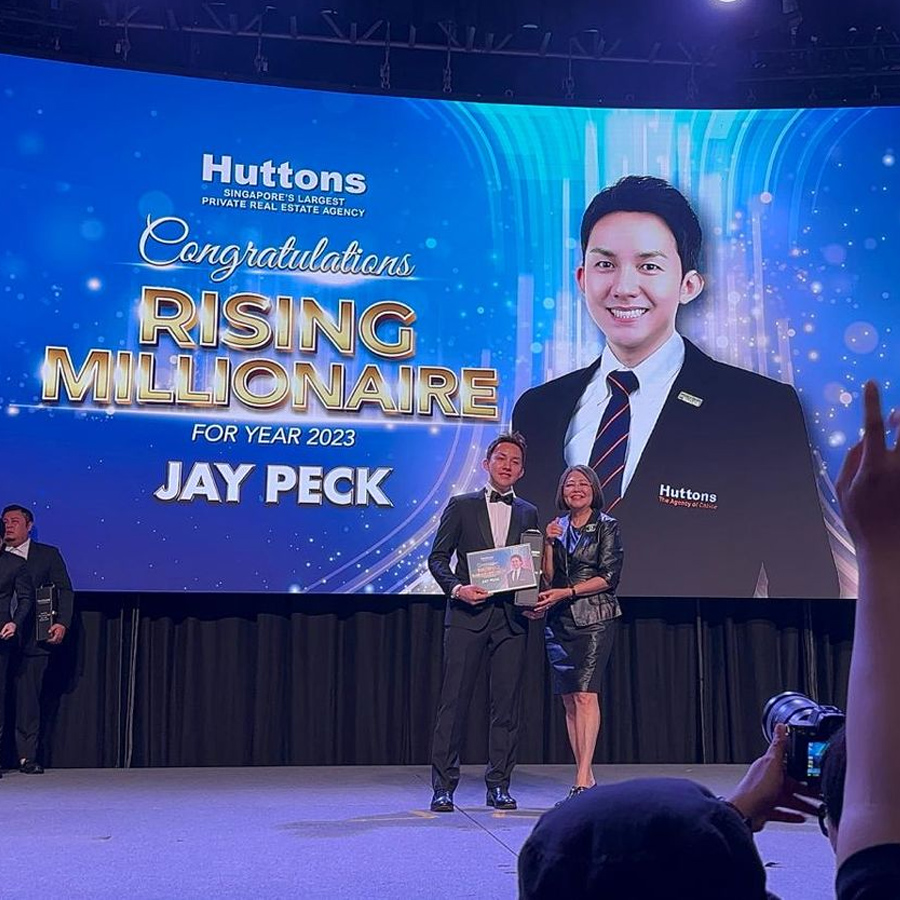

What being a Top Producer means

While accolades are always nice, they are important to Peck, not merely as a measure of his success but also as a means of establishing credibility and attracting new talent to his team.

In particular, he believes that achievements make it easier for potential candidates to identify successful individuals within the industry with whom they might like to work.

“My ultimate goal one day would be to build a good-sized team of real estate professionals,” says Peck. Although he is aware that he is not near where his ambitions lie, achieving such lofty heights begins with key relationships, thus emphasising the importance of having a culture of partnerships within his team.

Instead, Peck encourages his team members to collaborate with him, sharing leads and collaborating on client engagements. He shows his downlines that he has “skin in the game” and is generous and willing to commit significant resources to their collective marketing efforts.

Your Real Estate Questions, Answered

-

It’s our first time purchasing / selling a home. How can we get this started??

I am always excited to speak to first timers – be it it’s your first time selling or buying a home or it could just be that it’s been a while since your last experience!

My advice to many of my clients, like yourself, is to start speaking to professionals in the field before making a decision on who to engage. More than understanding each realtor’s expertise, go beyond to understand the realtor as a person.

Buying / selling a home requires a hand-in-hand collaboration between your realtor and yourself. Hence, it’s important to engage a realtor that you are able to work well with and is able to safely put your trust in. -

What is the typical timeframe for completing a property transaction in Singapore?

For private properties, a transaction can be completed as soon as four weeks if the property is fully paid for and the loan has been redeemed. For properties with outstanding bank loans, the transaction is typically completed between eight to twelve weeks from the exercise date.

For HDBs, a transaction typically takes about 3 months from the application date to complete. -

How do I determine the market value of my property?

The market value of a property, be it private properties or HDBs, is influenced by the latest transactions within the development and in the vicinity..

For private properties, you can find out the valuation of a specific property through a banker or the banks’ panel of appointed valuers.

For HDB properties, the actual valuation can only be made known by requesting from HDB itself after the Option to Purchase has been issued. However, with experience, your agent should be able to give you a rough gauge of the indicative valuation of the property before you commit to a sale or a purchase. -

Does working with multiple agents improve success rates?

My recommendation is to engage only one agent to assist you at a time.

When you have more than one agent competing for the sale of your home, you run the risk of them wanting to close the deal fast before others do, instead of having your interests at heart.

When choosing an agent, always read reviews on them and speak to them personally to have a sense of whether he / she is able to best serve you and your family’s needs. A good agent is one who is prompt to take action and one who is willing to invest their time, energy and money into helping you succeed in every way.

-

How can I sell my house and buy a new one without needing to rent in between?

This is a concern that has been raised by many of the home owners that I have come across. It’s a very real concern and having no where to stay is something that no one will ever want to experience, not especially if you have young children with you.

That said, this concern can be easily resolved by careful timeline planning. A good agent will not be hurried into marketing your home without a plan in mind. A good agent will always have your sale and purchase timeline planned out first before everything else.

I have helped many of my clients transit successfully to their next home without the need to rent in the interim. My clients, Jerome and Jemimah, have a similar concern and you can read their story here on how I have helped them address their concern. -

I am looking to buy a property in Singapore. How to determine how much I can afford?

You can set a budget for your property purchase by taking into consideration the financial resources that you have on hand from the different sources by asking yourselves these questions:

Bank Loan:

How much is the bank willing to lend me?

You can find out how much you can borrow from the bank by applying for an In-Principle Approval (IPA) though a banker.

Remember, determining affordability is not just about what you can borrow but also about what you can comfortably repay. Hence, also ask yourselves:

How much is a comfortable amount I am able to repay for my monthly mortgage?

Savings in Bank:

How much of my savings in bank am I willing to set aside for the down payment of my property purchase?

Savings in your CPF Ordinary Account:

How much of my savings in my OA am I willing to set aside for the down payment of my property purchase?

Housing Grants from Government: [applicable only if you are buying HDB and is eligible for housing grants]

To ensure that you have budgeted correctly, my advice is to get an experienced realtor to work through these in detail with you. The last thing you want is to have bought into something that is beyond your means and struggle your way through life. -

Do I need to pay a commission to my agent for representing me in a property purchase, and if so, how much?

For the purchase of private properties, you typically do not need to pay your agent commission as he / she will usually get a cut of the commission from the seller agent.

However, there are instances where some buyers may choose to pay their appointed agent commission so that they can be assured that he / she will act for their best interest.

For the purchase of HDBs, you will have to pay your agent commission to represent you. The typical market rate that agents charge buyers is 1% of the purchase price.

TESTIMONIALS

from clients

GET IN TOUCH WITH JAY